How to Write a Detailed Business Plan Step-by-Step [Free Template]

Jump to

Before you write a detailed business plan, start with a one-page business planWhen do you need a more detailed business plan?How to write a detailed business planTips to write a detailed business planDownload a free business plan templateUse your detailed business plan to grow your businessWriting a business plan is one of the most valuable things you can do for your business.

Study after study proves that business planning significantly improves your chances of success by up to 30 percent1. That’s because the planning process helps you think about all aspects of your business and how it will operate and grow.

Ready to write your own detailed business plan? Here’s everything you need (along with a free business plan template) to create your plan.

Before you write a detailed business plan, start with a one-page business plan

Despite the benefits of business planning, it’s easy to procrastinate writing a business plan.

Most people would prefer to work hands-on in their business rather than think about business strategy. That’s why, if you’re writing a business plan for the first time, we recommend you start with a simpler and shorter one-page business plan.

With a one-page plan, there’s no need to go into a lot of details or dive deep into financial projections—you just write down the fundamentals of your business and how it works.

A one-page plan should cover:

- Value proposition

- Market need

- Your solution

- Competition

- Target market

- Sales and marketing

- Budget and sales goals

- Milestones

- Team summary

- Key partners

- Funding needs

A one-page business plan is a great jumping-off point in the planning process. It’ll give you an overview of your business and help you quickly refine your ideas.

Check out our guide to writing a simple one-page business plan for detailed instructions, examples, and a free downloadable one-page plan template.

When do you need a more detailed business plan?

While I will always recommend starting with the one-page plan format, there are times when a more detailed plan is necessary:

- Flesh out sections of your plan: You need to better understand how your marketing, operations, or other business functions will operate.

- Build a more detailed financial forecast: A one-page plan only includes a summary of your financial projections. A detailed plan includes a full financial forecast, including a profit and loss statement, balance sheet, and cash flow forecast to better measure performance (here's more information about creating a cash flow forecast.

- Prepare for lenders and investors: While they may not read the full plan, any investor will ask in-depth questions that you can only answer by spending time writing a detailed business plan.

- Sell your business: Use your business plan as part of your sales pitch, and show potential buyers all the details of how your business works.

Related Reading: Can You Use ChatGPT to Write a Business Plan? Yes, Here’s How

How to write a detailed business plan

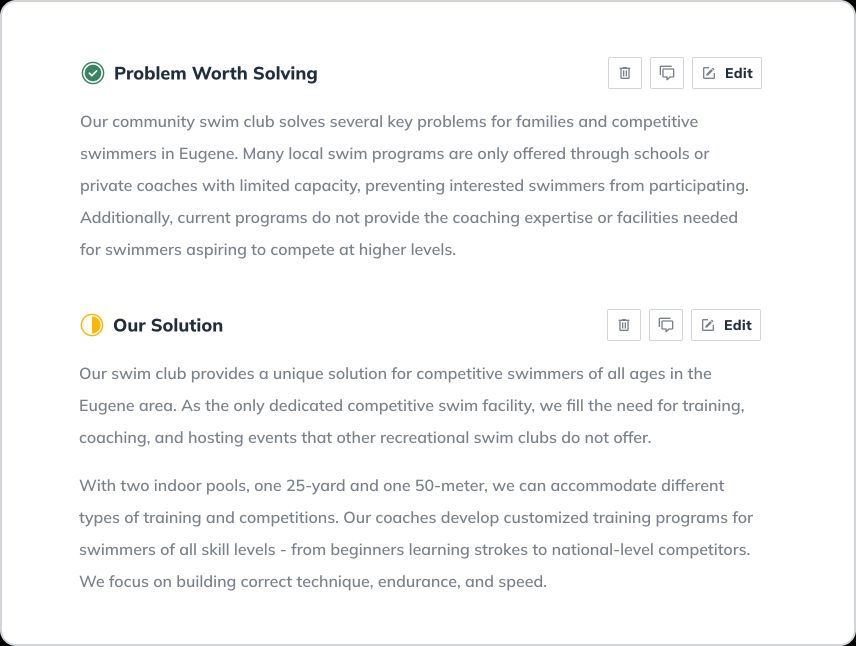

Let’s walk through writing a detailed business plan step-by-step and explore an example of what a finished business plan (for a local swim club Pools & Laps) built with LivePlan’s business plan builder looks like.

1. Executive summary

Yes, the executive summary comes first in your plan, but you should write it last—once you know all the details of your business plan.

It is just a summary of your full plan, so be careful not to be too repetitive—keep it between one or two pages and highlight:

- Your opportunity: This summarizes what your business does, what problem it solves, and who your customers are. This is where you want readers to get excited about your business

- Your team: For investors, your business’s team is often even more important than what the business is. Briefly highlight why your team is uniquely qualified to build the business and make it successful.

- Financials: What are the highlights of your financial forecast? Summarize your sales goals, when you plan to be profitable, and how much money you need to get your business off the ground.

For existing businesses, write the executive summary for your audience—whether it’s investors, business partners, or employees. Think about what your audience will want to know, and just hit the highlights.

2. Opportunity

The “opportunity” section of your business plan is all about the products and services that you are creating. The goal is to explain why your business is exciting and the problems that it solves for people. You’ll want to cover:

Problem & solution

Every successful business solves a problem for its customers. Their products and services make people’s lives easier or fill an unmet need in the marketplace.

In this section, you’ll want to explain the problem that you solve, whom you solve it for, and what your solution is. This is where you go in-depth to describe what you do and how you improve the lives of your customers.

Target market

In the previous section, you summarized your target customer. Now you’ll want to describe them in much greater detail. When you detail your market research in your business plan, You’ll want to cover things like your target market’s demographics (age, gender, location, etc.) and psychographics (hobbies and other behaviors).

Ideally, you can also estimate the size of your target market so you know how many potential customers you might have.

Competition

Every business has competition, so don’t leave this section out. You’ll need to explain what other companies are doing to serve your customers or if your customers have other options for solving the problem you are solving.

Explain how your approach is different and better than your competitors, whether it’s better features, pricing, or location. Explain why a customer would come to you instead of going to another company.

3. Execution

This section of your business plan dives into how you will accomplish your goals. While the Opportunity section discussed what you’re doing, you now need to explain the specifics of how you will do it.

Further Reading

Marketing & sales

What marketing tactics will you use to get the word out about your business? You’ll want to explain how you get customers to your door and what the sales process looks like. For businesses with a sales force, explain how the sales team gets leads and what the process is like for closing a sale.

Operations

Depending on the type of business that you are starting, the operations section needs to be customized to meet your needs. If you are building a mail-order business, you’ll want to cover how you source your products and how fulfillment will work.

If you’re building a manufacturing business, explain the manufacturing process and the necessary facilities. This is where you’ll talk about how your business “works,” meaning you should explain what day-to-day functions and processes are needed to make your business successful.

Milestones & metrics

So far, your business plan has mostly discussed what you’re doing and how you will do it.

The milestones and metrics section is all about timing. Your plan should highlight key dates and goals that you intend to hit. You don’t need extensive project planning in this section, just key milestones that you want to hit and when you plan to hit them.

You should also discuss key metrics: the numbers you will track to determine your success.

4. Company

The Company section of your business plan should explain your business’s overall structure and the team behind it.

Organizational structure

Describe your location, facilities, and anything else about your physical location relevant to your business. You’ll also want to explain the legal structure of your business—are you an S-corp, C-corp, or an LLC? What does company ownership look like?

Team

Arguably one of the most important parts of your plan when seeking investment is the “Team” section. This should explain who you are and who else is helping you run the business. Focus on experience and qualifications for building the type of business that you want to build.

It’s OK if you don’t have a complete team yet. Just highlight the key roles that you need to fill and the type of person you hope to hire for each role.

5. Financial plan and forecasts

Your business plan now covers the “what,” the “how,” and the “when” for your business. Now it’s time to talk about money.

Financial forecasts

What revenue do you plan on bringing in, and when? What kind of expenses will you have? How much cash will you need?

These are the types of questions you’ll answer by creating detailed forecasts. Don’t worry about getting it perfect, these are just educated guesses. Your goal is to get numbers down that seem reasonable so you can review and revise financial expectations as you run your business.

You’ll want to cover sales, expenses, personnel costs, asset purchases, cash, etc, for at least the first 12 months of your business. If you can, also create educated guesses for the following two years in annual totals.

If you intend to pursue funding, it’s worth noting that some investors and lenders might want to see a five-year forecast. For most other cases, three years is usually enough.

Financing

If you’re raising money for your business, the Financing section is where you describe how much you need. Whether you’re getting loans or investments, you should highlight what and when you need it.

Ideally, you’ll also want to summarize the specific ways you’ll use the funding once you have it.

For more specifics, check out our write-up explaining what to include in your business plan for a bank loan.

Historical Financial statements

If your business is up and running, you should also include your profit and loss statement, balance sheet, and cash flow statement. These are the historical record of your business performance and will be required by lenders, investors, and anyone considering buying your business.

If you don’t want lengthy financial statements overwhelming this section of your business plan, you can just include the most recent statements and include the rest within your appendix.

6. Appendix

The final section of your business plan is the appendix. Include detailed financial forecasts here and any other key documentation for your business.

The appendix is also the place for product schematics, patent information, or any other details that aren’t appropriate for the main body of the plan but need to be included for reference.

Related Articles

Tips to write a detailed business plan

Keep it brief

You may not be limited to one page, but that doesn’t mean you need to write a novel. Keep your business plan focused using clear, plain language and avoiding jargon. Make your plan easier to skim by using short sentences, bulleted lists, and visuals. Remember, you can always come back and add more details.

Related Reading: 7 tips to make a high-quality business plan

Start with what you know

Don’t worry about following a strict top-to-bottom approach. Instead, build momentum by starting with sections you know well. This will help you get information down and ultimately make you more likely to complete your business plan.

Set time limits

You don’t have to write your business plan in one sitting. It may be more valuable to set a time limit, see how much you get done, and return to it again in another session. This will keep you focused and productive and help you fit plan writing into your other responsibilities.

Reference business plan examples

Real-world business plan examples from your industry can provide valuable insights into how others have successfully presented their ideas, strategies, and financials. Exploring these examples can inspire your own approach and offer practical guidance on what to include and how to tailor it to your specific needs.

Just be sure not to copy and paste anything.

Prioritize sections that really matter

When writing a detailed business plan, focus on the parts most important to you and your business.

If you plan on distributing your plan to outsiders, you should complete every section. But, if your plan is just for internal use, focus on the areas that will help you right now.

Download a free business plan template

Are you ready to write your detailed business plan? Get started by downloading our free business plan template. With that, you will be well on your way to a better business strategy, with all of the necessary information expected in a more detailed plan.

If you want to improve your ability to build a healthy, growing business, consider LivePlan.

It’s a product that makes planning easy and features a guided business plan creator, drag-and-drop financial forecasting tools, and an AI-powered LivePlan Assistant to help you write, generate ideas, and analyze your business performance.

Use your detailed business plan to grow your business

Your business plan isn’t just a document to attract investors or close a bank loan. It’s a tool that helps you better manage and grow your business. And you’ll get the most value from your business plan if you use it as part of a growth planning process.

With growth planning, you’ll easily create and execute your plan, track performance, identify opportunities and issues, and consistently revise your strategy. It’s a flexible process that encourages you to build a plan that fits your needs.

So, whether you stick with a one-page plan or expand into a more detailed business plan—you’ll be ready to start growth planning.

Sources in this article

- Parsons, Noah. “Do You Need a Business Plan? This Study Says Yes” Bplans: Free Business Planning Resources and Templates, 10 May 2024, www.bplans.com/business-planning/basics/research.

More in Planning

planning

LivePlan vs Venturekit: Comprehensive Business Planning Software Comparison (2025)

planning

Paid Vs. Free Business Plan Software — Which is Right For You?

planning

What Is Accounts Receivable (AR)? [Definition + 6 Ways to Improve]

planning